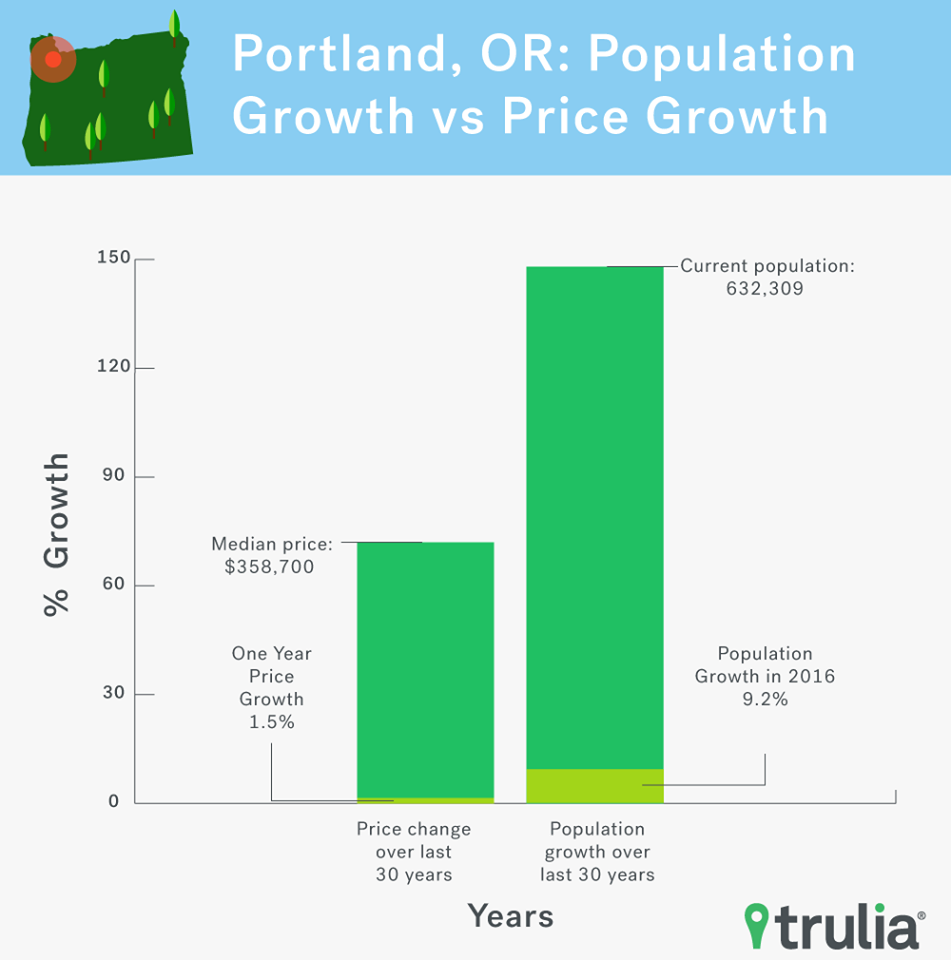

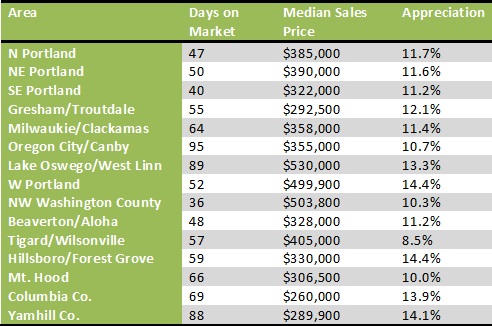

Portland’s real estate market is booming!

May 2nd, 2017

May 2nd, 2017  admin

admin Fiscal Cliff Bill Addresses Key Housing/Real Estate Issues

January 5th, 2013

January 5th, 2013  admin

admin The Senate bill that finally passed the House by a 259-167 vote extended a number of federal tax code provisions that are important to homebuyers, sellers, builders and real estate professionals.

For huge numbers of financially distressed owners of homes with underwater mortgages, this was the biggest issue in the entire fiscal cliff debate. The mortgage debt relief provisions in the tax code, first enacted in 2007, expired at midnight Dec. 31.

Had Congress not acted, the tax code would have reverted to its pre-2007 treatment of mortgage principal reductions or cancellations by lenders, whether through loan modifications, short sales, deeds-in-lieu or foreclosures: All principal balances written off would be treated as ordinary income to the homeowners who received them.

For illustration, if a lender wrote off $100,000 of debt to facilitate a short sale, the seller would be taxed on that $100,000 at regular marginal rates, just as if he or she had earned it as salary.

A return to taxation of principal reductions would have disrupted short sales — a growing segment of the home real estate market — in 2013, and almost certainly would have encouraged more distressed owners to opt for foreclosure and bankruptcy.

Deduction of mortgage insurance premiums

The bill retroactively extended this benefit to cover all of 2012, plus continues it through 2013. Qualified borrowers who pay private mortgage insurance premiums or guarantee fees on conventional, low down payment home loans, FHA, VA and Rural Housing mortgages will be able to write off those premiums along with their mortgage interest on federal tax returns. The retroactive feature is crucial because Congress had allowed this deduction to lapse at the end of 2011. There are limitations, however: The write-off is available only to borrowers who have an adjusted gross income below $110,000.