7 Reasons to Own Your Portland Home

7 Reasons to Own Your Portland Home

1. Tax breaks. The U.S. Tax Code lets you deduct the interest you pay on your mortgage, your property taxes, as well as some of the costs involved in buying your home.

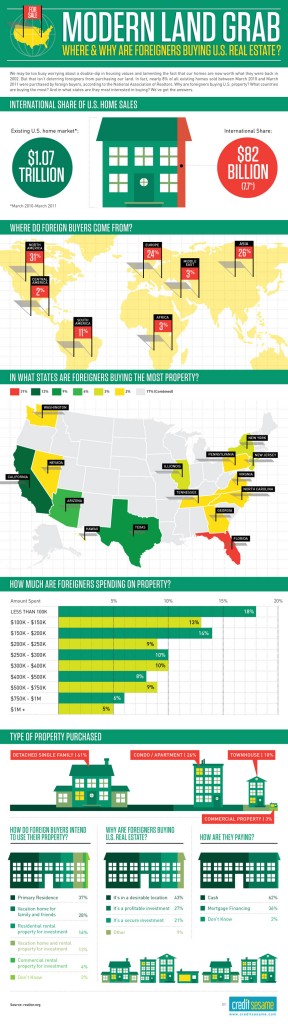

2. Appreciation. Real estate has long-term, stable growth in value. While year-to-year fluctuations are normal, median existing-home sale prices have increased on average 6.5 percent each year from 1972 through 2005, and increased 88.5 percent over the last 10 years, according to the NATIONAL ASSOCIATION OF REALTORS®. In addition, the number ofU.S. households is expected to rise 15 percent over the next decade, creating continued high demand for housing.

March 1st, 2012

March 1st, 2012  admin

admin