In April of this year I sent out a newsletter covering this topic. The article I wrote about received a lot of feedback so I thought it was worth repeating here on my blog. Some of you may have read the Time magazine cover story questioning the value of homeownership, or you may have found yourself out with friends where people were talking about how buying a home is a stupid thing to do. It’s not.

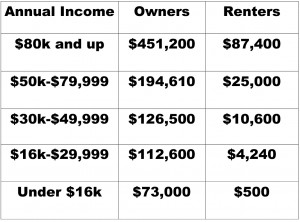

Take a look at the table below:

These numbers are from the Federal Reserve Board’s triennial Survey of Consumer Finances, last completed in 2007. The next survey, which they’re working on now, will undoubtedly show a decrease in homeowner net worth, but the story these numbers tell won’t change, because renters have fared even worse in the economic downturn than homeowners.

Note that at every level of income, homeowners have a significantly higher net worth than renters. This is a very important point to stress, because when you tell people that homeowners are consistently richer than renters, they may counter with the argument that you are comparing apples to oranges, which all that shows is that rich people are more likely to be homeowners. Rich people may be more likely to buy homes, but that’s not what the Federal Reserve Board is measuring here. What they’re measuring is how, no matter what your income is, buying a home leads to having more wealth- that is, being richer.

On average, a homeowner’s wealth is 46 times that of a renter’s, and the lower the income, the greater the gap. If you make between $16,000 and $29,000, the ratio is 27 times; at under $16,000 it’s 146 times. The lower the person’s income, the greater the incentive should be to sacrifice to buy a home. What most people who decry the wisdom of owning a home forget is that everyone has to pay a mortgage. The only question is, is it going to be your own or someone else’s?

A home is not merely an asset which goes up or down in value, it’s also a product from which you derive utility, like your car (which always goes down in value, yet people keep buying them). One of the arguments you will come across goes something like this: If you were to rent and take that extra money and put it in the stock market, at the end of ten years, you will have made more money than the homeowner. There are a couple of problems with this analysis, however. First, is your rent payment really that much cheaper than a mortgage payment would be on a comparable property? Your average apartment is simply not as nice, i.e. has a lower utility value, than your average house. If I were to buy a 600 sq. ft. condo in the kind of modest neighborhood where rentals are typically found, would my mortgage payment really be that much higher, if at all, than your rent payment? Condos are going pretty cheap right now, and my interest rate is likely to be around 4%.

Second, are you really going to invest that extra money? Because every study ever done by an organization, public or private, says you won’t. One of the most powerful ways owning a home builds wealth is through forced savings. Even if the value of my asset (home) drops, it’s still cutting into a savings account (my equity) that I actually have. When you pay rent, there is no savings account to cut into. How is that so smart?

The Wall Street Journal came out with a direct response to the Time Magazine article, and we may see more responses in other media outlets. To check out the article go here.

*content from this article was obtained from Oregon First

December 1st, 2011

December 1st, 2011  admin

admin  Posted in

Posted in